Case Study: How This 5-Year-Old “Boring” Blog Earns $100+/mo Passive Income

Disclosure: Some links on this page may be referral links. If you choose to use them, they help support this site at no extra cost to you.

If you are looking for a real-world website valuation case study, the story of FireProofDepot.com is the perfect place to start.

Most people think you need a massive tech startup or a viral social media account to make money online. But in the world of digital assets, “boring” is often better.

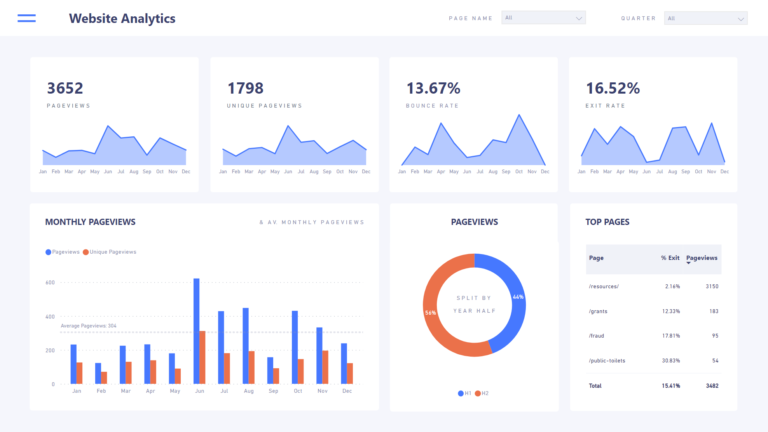

We recently analyzed a listing on Flippa—FireProofDepot.com—that perfectly illustrates how a simple, focused website can become a steady income generator with almost zero overhead.

The “Due Diligence” Checklist

Due Diligence: What We Checked Before This Valuation

- Backlink Profile: “We looked at the 389 referring domains. High-quality links from safety forums are what build the ‘Aged Authority’ we mentioned.”

- Traffic Consistency: “The traffic has been stable for 5 years. This reduces the risk for a new buyer compared to a ‘trending’ site.”

- Content Originality: “The fact that 198 articles were human-written (No AI) is a major valuation booster in 2026.”

The Asset Breakdown

- Niche: Fire Safety (Homeowners & Firefighters)

- Age: 5 Years (Started March 2020)

- Content: 198 Human-written articles

- Monthly Profit: $107 (on $122 revenue)

- Profit Margin: 99%

Why this matters: This site has “Aged Authority.” In 2026, where AI-generated content is everywhere, search engines like Google are prioritizing older domains with human-written content. FireProof Depot has been around for half a decade, making its traffic much more stable than a new site.

Why This Fire Safety Niche is a Profitable Boring Niche

In this website valuation case study, we see how a simple asset can beat high-hype startups by focusing on undervalued websites for passive income.

How It Makes Money

This site uses a “hands-off” monetization strategy:

- Display Ads (76%): Using Journey by Mediavine.

- Affiliate Marketing (24%): Amazon Associates.

The beauty here? The seller mentioned it only takes 2 hours per week to maintain. That is the definition of a digital side hustle.

The “Hidden Value” Analysis (Why it’s a good deal)

Why would someone buy a site making “only” $100 a month?

- The Multiple: It sold at approximately a 2.8x annual profit multiple. For a buyer, that’s a 35% annual return on their investment. Compare that to the stock market or a savings account!

- Low Expenses: With hosting costing only $1/month, there is virtually no risk of the business “going under” due to costs.

- Growth Potential: The site has almost no structured SEO strategy and zero social media presence. A new owner could easily double the income by adding more affiliate-focused content or improving the site’s layout.

What Can You Learn From This?

You don’t have to build the next Facebook. You just need to find a niche where people have real questions (like “Is vanilla extract flammable?”) and provide clear, human answers.

Key Takeaway: If you own an old blog or a domain from a project you started years ago, don’t let it sit idle. It might already have the “Aged Authority” that buyers are looking for right now.

Ready to find your own “FireProof Depot”?

The best way to learn the market is to see what is actually selling. You can browse recently sold listings and live auctions to see what niches are trending.

👉 Browse Live Website Listings on Flippa

Frequently Asked Questions about Website Valuation

Q: What is a standard profit multiple in 2026?

- A: For content sites, we typically see 2.5x to 4.0x annual profit. This case study’s 2.8x is a very fair entry point for a beginner.

Q: Does domain age really matter?

- A: Yes. As shown in this website valuation case study, a 5-year-old domain has a ‘trust factor’ with search engines that new domains simply cannot buy.